The White House is proposing new protections for seniors seeking to roll over their 401(k) account balances into individual retirement accounts (IRAs), an extension of a federal war on “junk fees” spearheaded by the Consumer Financial Protection Bureau (CFPB). This is according to reporting by the Wall Street Journal, comments from the U.S. Department of Labor and President Joe Biden.

The Department of Labor aims to extend a fiduciary rule already in place for 401(k)s managed by employers to currently-uncovered IRAs. The existing 401(k) rule was implemented with the Employee Retirement Income Security Act of 1974 (ERISA).

“Requiring investment advice providers to comply with fiduciary standards protects retirement investors from harmful conflicts of interest,” the Labor Department said of the proposal. “Conflicts of interest can put an investment advice provider in the position of choosing between what’s good for them and what’s best for you. That could result in excess fees and/or lost investment returns that reduce a person’s retirement savings.”

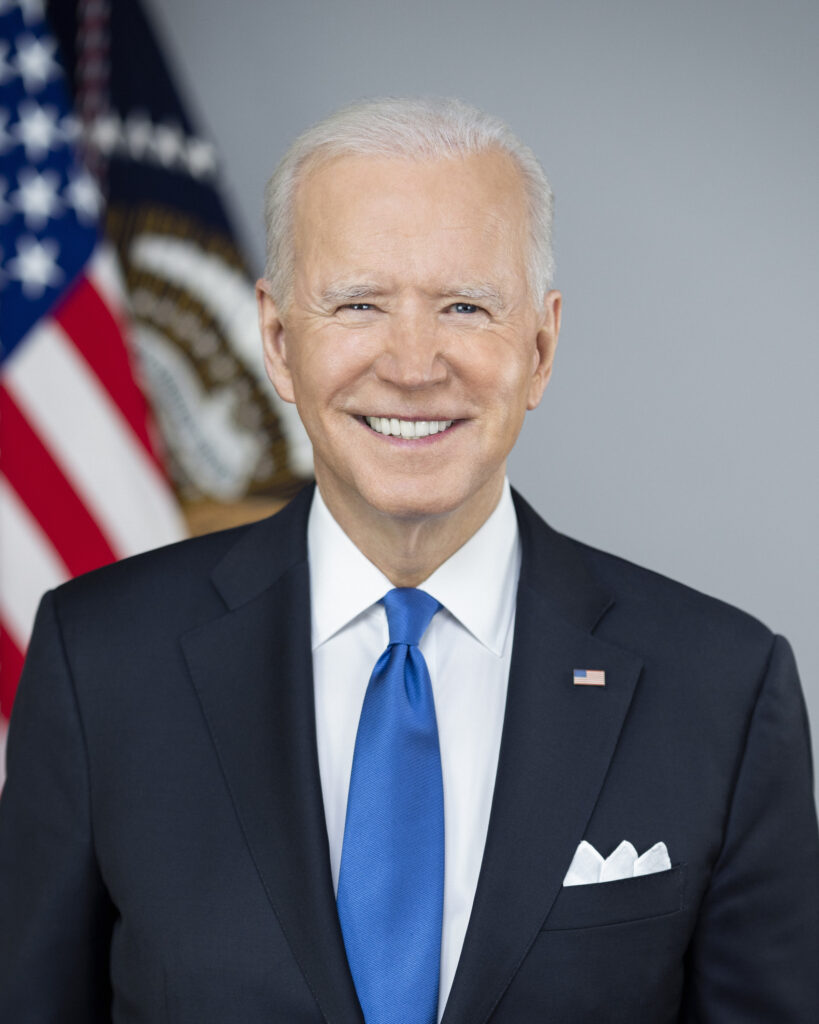

In an event at the White House on Tuesday, President Biden addressed his administration’s desire to extend these existing rules beyond their current limitations.

“It will protect seniors from being exploited,” he said. “It will protect many trustworthy financial advisors out there who are doing the right thing from unfair competition. Now, they won’t be undercut by competitors willing to use deception or underhanded tactics to make a profit.”

Biden went on to say the rule is rooted in the idea of “basic fairness,” and that “people are tired of being played for suckers.”

Critics of the move say that the rule would create an unnecessary regulatory burden for advisory firms, and could “reduce the number of advisers willing to work with investors, especially those with smaller accounts,” according to the Wall Street Journal.

With retirement periods lasting longer, there is a lack of adequate education on the proper management of financial resources that might need to last as long as 30 years, according to Fred Reish, an attorney specializing in employee benefits who spoke to the Journal.

“The Labor Department is worried about people’s life savings leaving the 401(k) world, where fiduciary rules apply, to go into IRAs, where prices can be higher and investors may not have the sophistication to identify advisers’ conflicts of interest,” Reish told the outlet.

Shortly after the president’s remarks, the Department of Labor’s Employee Benefits Security Administration (EBSA) posted a document for consumers answering questions about how the rule could impact them. The White House also released an accompanying “fact sheet” with other information about the proposal.