Almost all reverse mortgage lenders were anticipating a decline in loan applications and closings as a result of the financial assessment that took effect in late April. Now, two months after its implementation, both lenders and the Department of Housing and Urban Development are beginning to shed light on the immediate effects of the new rule.

The initial projections were varied: In an initial RMD poll conducted as lenders were preparing for the assessment’s implementation, about 12% of lenders reported anticipating a less-than 10% impact to loan volume. More than half, or 56%, said they anticipated losing more than 15% of their loan volume as a result.

Early data shows application volumes are down 40% from March levels before the financial assessment deadline, when application volume surged, according to data provided by Reverse Market Insight. Wholesale is down substantially more than retail, RMI says.

But the immediate effect may be short-lived.

“The good news is that it’s already trending back upward,” says John Lunde, RMI president, “which is a lot better than the aftermath of September 30, 2013, when we bumped along the bottom volume-wise for several months.”

HUD implemented new principal limit factors on September 30, 2013, resulting in a sustained decline to reverse mortgage volume.

Anecdotally, the financial assessment impact, while still early to make any long-term predictions, appears deeper than initially thought by reverse mortgage professionals who responded to a poll conducted last week on RMD.

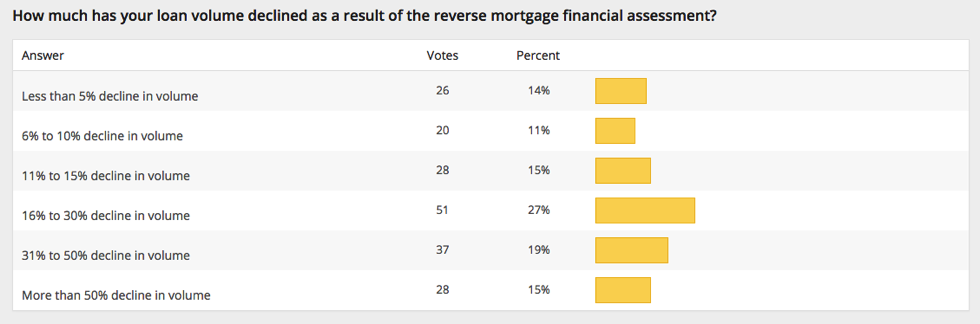

Among 190 respondents, a majority, or 54%, are reporting more than 15% volume decline. Among those respondents, 15% say the decline is more than 50%.

[Poll results as of 6/29/15]

Some appear to be faring better, according to the poll findings. Similar to the predictive poll, 14% says volume has gone down less than 5% and 11% say they are experiencing an 11% to 15% decline in volume.

Lender and broker accounts are also varied. Lenders acknowledge the impact to volume, but remain largely positive on the shift as it promotes long-term reverse mortgage program stability and a safer product for borrowers.

Originators have reported a definite shift in the origination process, but with outcomes that so far have been beneficial to borrowers without being detrimental to business.

Written by Elizabeth Ecker